They have come up with some great products in the past, but not all have gathered traction. Will no fees and Daily Cash change that?

Apple Card Is It Worth Considering

Every single time Apple announces a new product launch there is quite a kerfuffle, and the Apply card unveiled last week is without exception. The Apple card certainly has the potential to change the way the industry operates. However, when looking at a new card like many others I’m sure, the first things I want to know about are the offers, or sign up bonuses. And this card doesn’t really have any, so let’s hope the innovative nature of it entices.

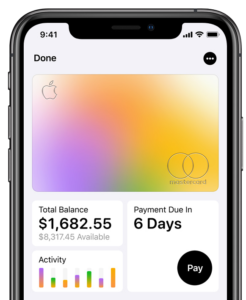

Your phone is your bank

So we all know that to get an iPhone now you will be looking to spend almost £1000, so already it’s starting to look like a bank due to the value. On top of that however, the Apple Card has been created as a digital experience, with transactions, rewards information, and payment reminders all living in the Wallet app on your iPhone.

1, 2, 3 Account ringing any Bells (Santander)

No sign up bonus is on offer, however Apple are offering cash sums upon purchases, this can be up to 3% when purchasing directly from Apple (including all services like Apple Music), 2 percent on all purchases made with Apple Pay, and 1 percent cash back on physical card purchases.

Feeless

Apple have gone above and beyond to ensure you are not hit with fees when using the card, not only are there no annual fees for the card or account, but also foreign transactions, late payments, and exceeding your credit limit will not hinder you. This is something which the credit card market has been crying out for, with hidden fees plaguing customers, hopefully other card issuers will take note of this and follow suit. While we are yet to establish what the interest on the card itself will be, Apple have confirmed they want this to be low, 10% is the rate which is being whispered in the Applesphere.

Negs

Purchase protection, Apple have decided not to offer any purchase protection on the card itself, which is quite a major flaw considering the credit card marketplace as this is a common and useful attribute to most cards.

Instant Cashboack

Cashback isn’t a new thing, but the delivery method which Apple have opted for is a bit more innovative. The 1, 2, 3% cashback will appear in your account the same day the transaction is posted (Daily Cash), this means you will have access to is sooner, rather than having to wait till the end on the month like most cards.

Physically Gorgeous

Apple simple couldn’t release this concept without a sleek and eye-catching physical product. The new laser-etched titanium truly looks a masterpiece, and with a minimalistic design to both improve security and add a touch of class to a concept which has been with us for decades, the credit card. The card itself has only a magstripe, your name and a chip, so you don’t need to worry about having your card cloned.

The banking bit

Apple have not taken the leap into banking just yet, the cards underwriter is Goldman Sachs, with the payment processing being handled by Mastercard, Apple at present is simply a co-brand partner. As to why the tech brand is throwing its hat into the credit card ring? By rewarding card. But, why is the tech giant taking the leap into this, well one of the reasons could be they are looking to get more stores accepting the Apple pay system, another could be they want to take over the world, but we will leave you to make up your mind on that one.

Even if you decide not to go for the Apple Card, it is worth keeping an eye on deals in the market as the competition will have to look at their offerings to compete with the feeless model.